Inheritance tax: How much will my children have to pay?

Jonathon Jay of DSW Wealth Planning explains why it is important to understand your liability and how to work it out

The inheritance tax rules have changed many times over the years but are still no easier to understand. In my view the complexity is a real barrier for many people. It is so difficult to work out whether their family will have to pay after their death and if so, how much, that it stops them seeking advice and they never get to understand their options.

Of course, if you are a married couple or in a civil partnership and planning to leave all your assets to each other, you may not need to worry as there is no inheritance tax payable – at least not when the first one dies.

However, if you are leaving your estate to anyone else – whether family, friends or the local dogs’ home – it is worth trying to work out your liability and considering ways to minimise the amount they will have to pay.

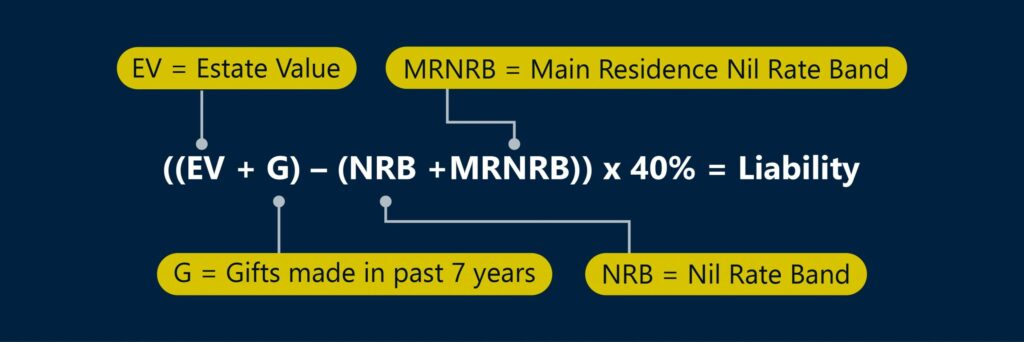

If you have a mathematical mindset, then the formula below sums it up in one line. If not, the following four steps should help you to roughly work it out. If all else fails, consult a professional wealth planner!

1. Calculate the value of your estate

This is the sum of your assets (including your home, any other property, cash and investments) minus your liabilities (which will include any long- or short-term debts such as credit cards, loans or mortgages). Pensions typically do not count as part of your estate but it will depend on the way the pension is structured – for more clarity, contact your pension provider.

2. Add relevant gifts

If you have given away money or assets – whether directly or indirectly through the use of Trusts – they may still be subject to inheritance tax for seven years afterwards and additional rules may apply. However, there are some allowances and exemptions which you can find on the government website here.

Gifts are one of the more complex areas of inheritance tax and the rules can easily catch you out. Your liability depends on the ways the gifts were made, whether directly or into a Trust. If it is via a Trust, it is important to seek further guidance on how the gifts interact with the inheritance tax rules. If you have received advice on the gifts previously, this should have been made clear to you in the documentation.

3. Subtract your IHT allowances

There are two allowances that apply:

- Nil Rate Band – an allowance of £325,000 per individual. If you are married or in a civil partnership and you have left your assets to each other, when the first one dies, the surviving partner will inherit the other’s allowance – so when the second partner dies, they will have a total Nil Rate Band of £650,000.

- Main Residence Nil Rate Band – an additional allowance of up to £175,000 per individual for those who own their own home. Like the Nil Rate Band, this is inherited by the survivor in a marriage or civil partnership. However, the allowance is limited to the value of your home and only applies if it left to lineal descendants, which includes children, adopted children and stepchildren. It must also be left directly to them and not into a Discretionary Trust.

The allowance is reduced by £1 for every £2 that the estate value is in excess of £2 million. For example, if the estate is valued at £2.1 million then the allowance will be reduced by £50,000. Note that for this purpose, the estate value does NOT include amounts gifted, even if it is less than seven years since they were made.

4. Calculate your liability

Once you have followed the first three steps, you will be left with a monetary figure. Provided it is greater than zero, your liability will be 40% of this amount.

The inheritance tax rules can be very overwhelming, but if want to maximise the amount you leave behind for your family, friends or charities, then it is important to seek specialist advice.

Important Notes

- Levels, bases and reliefs from taxation may be subject to change.

- The information contained within this article is for guidance only and does not constitute advice which should be sought before taking any action or inaction.

- The Financial Conduct Authority does not regulate taxation advice, estate planning, inheritance tax planning, wills or trusts.

DSW Wealth Planning is a trading name of Dow Schofield Watts Wealth Planning LLP which is an appointed representative of Corbel Partners Limited which is authorised and regulated by the Financial Conduct Authority.

Dow Schofield Watts Wealth Planning LLP is Registered in England and Wales. Registered Number: OC441562. Registered Office: 7400 Daresbury Park, Warrington, WA4 4BS.